Galaxy Next Generation, Inc. (OTCQB: GAXY) is a leading provider of interactive learning technology solutions. The Company’s hardware and software products are used to enhance learning in classrooms and improve communication, safety and security on campus. In an email interview with AlphaStreetGalaxy CEO Gary LeCroy spoke about the company’s financial performance and future plans.

What makes Galaxy different from other interactive learning services?

We believe our biggest differentiator is how our comprehensive product offering fits into a seamless system that supports student success while creating a safer learning environment. Our product offerings range from interactive touchscreens to classroom audio solutions, as well as complete intercom and paging systems and emergency communication tools.

All G2 products can be integrated into the entire G2 ecosystem. For example, our G2 Link Classroom audio system can be a standalone “voice lift” system in the classroom, or used as an endpoint for G2 Communicator and serve as two-way communication in the classroom for our solution. of intercom. In the same example, the teacher’s microphone can also be used as an emergency call button to trigger the need for a lock alert via G2 Secure.

This scalability and flexibility allows our education customers to adopt our products within their financial means and allows them to add products and expand the full G2 ecosystem over time. Our open source approach to product development has allowed us to quickly adapt to other technologies in the school environment so that we can truly integrate seamlessly into any classroom. This avoids distractions and allows the teacher to focus on promoting their students’ success while giving them peace of mind in a safer learning environment.

What is the main factor behind the impressive results of exercise 22, and do you think the trend will continue?

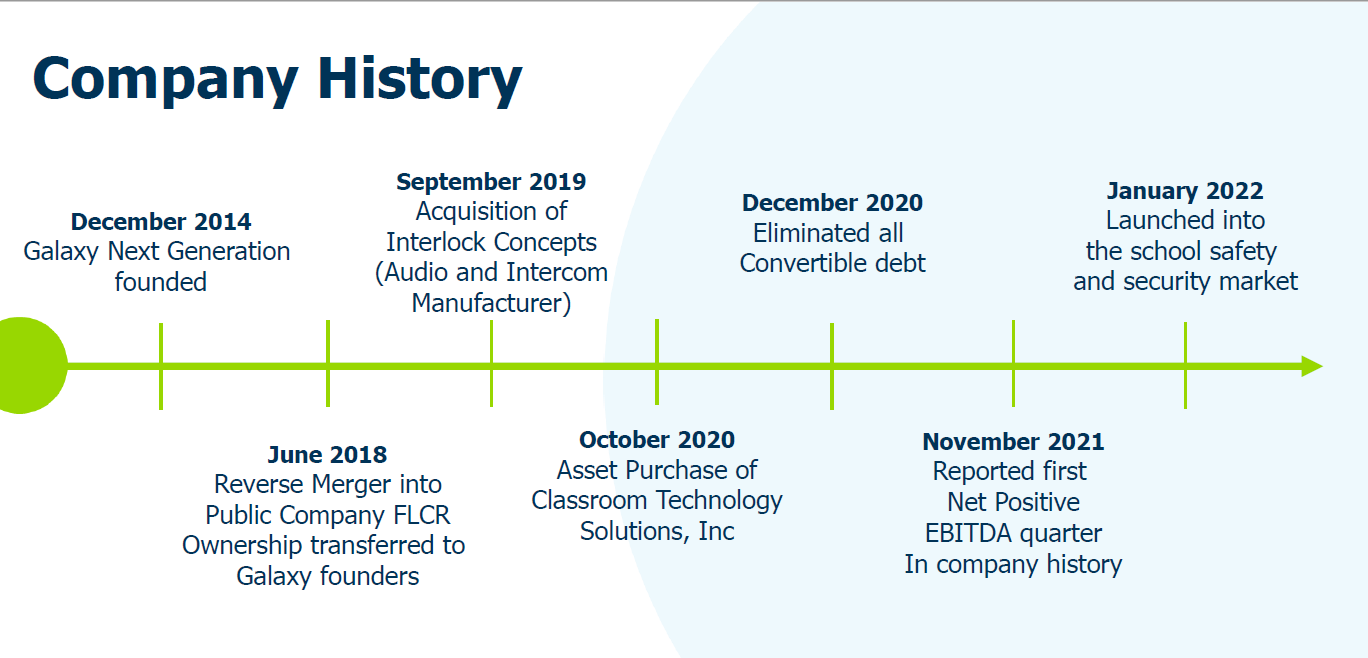

We have had a successful start to our 2023 fiscal year and expect this trend to continue. Fiscal 2022 was a transition year for Galaxy as our cash flow increased and our focus on servicing past debt, including the elimination of high interest convertible debt, enabled us to reduce our net operating loss from $24 million to just $6 million.

Trxade will focus more on core business and connect to POS systems: CEO Suren Ajjarapu

Our biggest goal heading into fiscal 2023 is to accelerate our revenue growth to help mitigate the remaining operating surplus. With the launch of two new products in January this year, we have seen an increase in interest from new and existing customers. We believe that a combination of increased headcount and sales efforts, coupled with new product launches, positions our organization for continued success and meeting our revenue goals.

While the outlook points to accelerating growth this year, how soon should the company become consistently profitable?

We believe it is possible to consistently achieve profitability in the relatively near future. When we look internally at some of our non-GAAP Adjusted EBITDA numbers, we see that quarterly revenue of only $1.5 million allows us to break even. We achieved similar revenue for several quarters over the past year, so coupled with some of the trends and goals mentioned above, achieving consistent quarterly revenue of $1.5 million to $2 million of dollars would enable us to achieve profitability on a future basis.

What is your long-term growth strategy?

It’s really threefold. First, we have and will continue to focus on developing our dealer network. Just recently, we signed with the second largest education reseller in the United States to advocate our products to their customers. More credible and well-known partners will help quickly make Galaxy a better known brand among schools nationwide, naturally increasing demand and revenue for us. Second, we will continue to execute on our strong product roadmap to ensure we stay ahead of market trends and bring new products and features to market consistently. New products allow us to review our existing customer base and create recurring revenue opportunities.

Finally, we continue to focus our marketing and sales efforts on our higher margin products. By shifting our revenue mix from low-margin interactive flat panels to our newer products such as G2 Link, G2 Secure and Communicator, we expect our profit margins to increase from ~25-35% to ~65-85%. In summary, increased revenue, coupled with increased profit margins, positions us for long-term growth in financial performance and market share within the industry.

What kind of effect has the pandemic had on Galaxy, and where is the company headed after COVID?

Like many businesses, we have seen disruptions due to the impact of COVID on the economy. We are still experiencing delays in our product supply chain due to component shortages and transportation issues, but we have started to see signs of a return to normality.

That said, we have remained nimble and positioned Galaxy for continued growth in the post-COVID environment. For example, the stimulus packages that have been given to schools through 2020 and 2021 have provided them with years of increased budgets to pursue. Schools will likely see increased funding in the 2024-2025 school year and we have certainly seen increased spending across the industry. Additionally, COVID has revealed many gaps in the educational technology landscapes in classrooms, as it was very difficult for some to quickly switch to an online or hybrid learning environment.

Having multiple recurring revenue streams is a winning strategy for LiveToBeHappy: CEO Kevin Cox

Our products are just what schools need to ensure they are equipped with the resources necessary for any learning, whether in the classroom, at home or in combination. We have been and will continue to directly market these new funding resources when working with potential new clients. As we continue to manage some of the lingering effects on our logistics, Galaxy has become a stronger company in the post-COVID world. We are focused on executing our operating strategy to drive value for all of our stakeholders, including our employees, customers, shareholders, and ultimately the students and teachers who will benefit from our range of products.